International shipping costs have surged as businesses prepare for the festive season earlier than usual, driven by disruptions from attacks in the Red Sea. The average cost of shipping a 40ft container from the Far East to northern Europe hit $4,343 last week, triple last year’s rate, according to Xeneta. Although prices haven't reached the peak seen after Yemen’s Houthi militants began targeting vessels in November, they are rebounding during the typically quiet spring months. Michael Aldwell, head of sea logistics at Kuehne + Nagel, noted, “The peak season has been brought forward.”

Ships now bypass the eastern Mediterranean, stopping at the western end for "trans-shipment" to countries like Italy, Greece, and Turkey, causing delays and increased dwell time. Ports in the western Mediterranean are strained by this disruption, congestion, and other shipping problems following the rerouting of voyages away from Yemen due to attacks by Iran-backed Houthi militias. Data from Clarksons shows a 90% drop in container ship arrivals in the Gulf of Aden compared to last year. Diverting vessels around the Cape of Good Hope adds 9-14 days to voyage times, causing hold-ups in ports like Algeciras and Tangier.

The global shipping industry faces numerous challenges: increased pirate attacks off Somalia, potential threats from Iranian forces in the Strait of Hormuz, reduced Panama Canal transits due to drought, and congestion in European ports handling a surge of vehicle imports from China.

FT May 26.2024

On the Airfreight side of things:

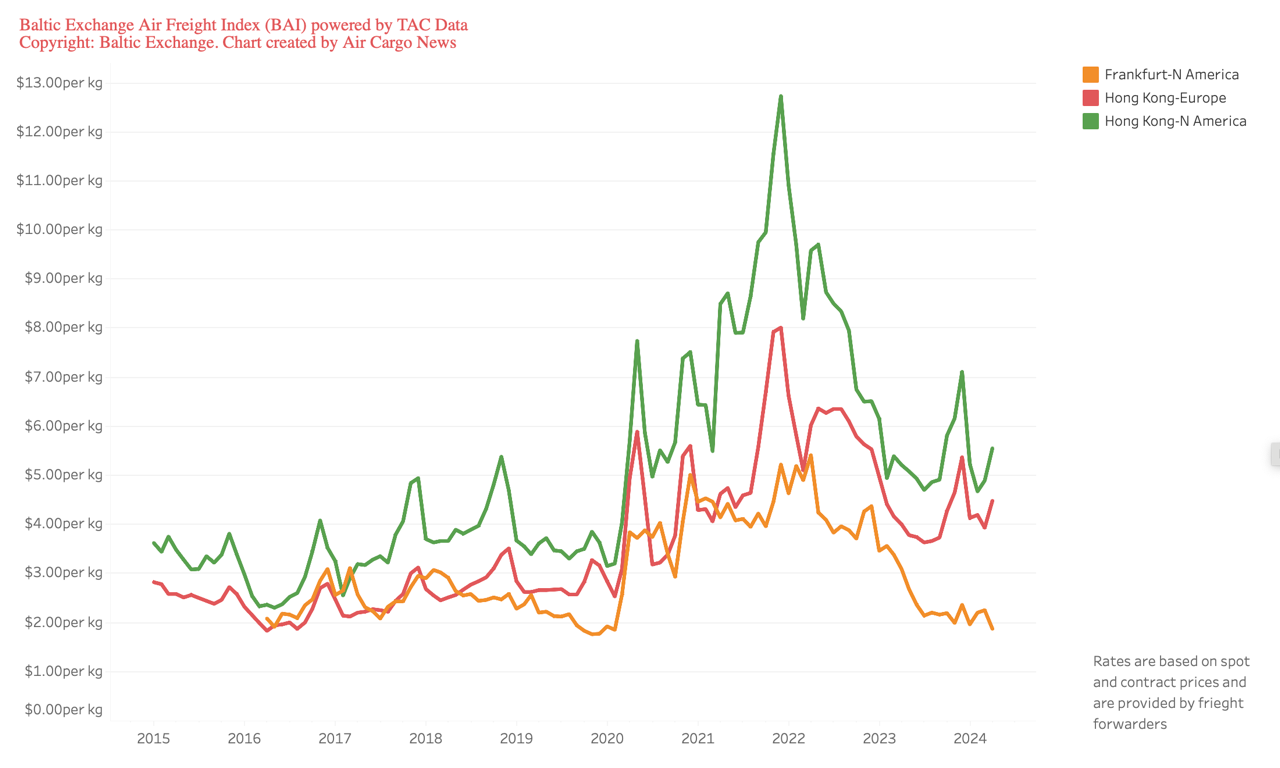

Rates on services from Hong Kong to Europe and North America are now ahead of last year’s levels as demand continues to surge.

The latest figures from the Baltic Exchange Airfreight Index (BAI) show that in April average all-in rates from Hong Kong to North America were up 6.5% year on year to $5.54 per kg.

Meanwhile, rates from Hong Kong to Europe in April increased by 12% year on year to $4.47 per kg.

April is the first time that rates on the two trades have simultaneously been ahead of last year’s levels since July 2022.

Figures from data provider WorldACD show that demand out of Asia increased 13% year on year between April 8 and April 21.

As well as benefitting from booming e-commerce demand, there has been some ongoing modal shift due to the Red Sea shipping crisis.